In the ever-evolving landscape of electric vehicles (EVs), a recent move by the Biden administration to grant a $6.6 billion loan to Rivian, an emerging competitor of Tesla, has stirred considerable debate. The scrutiny is set to intensify with the appointment of entrepreneur Vivek Ramaswamy and Tesla CEO Elon Musk to lead the Department of Government Efficiency (DOGE).

A Closer Look at the Political Dynamics

Ramaswamy, known for his success in biotechnology and critical stance on government spending, has been vocal about reevaluating the financial assistance provided to Rivian. His comments underscore a broader skepticism about the fiscal prudence of such substantial economic support. Ramaswamy argued on social media, “Biden is forking over $6.6 billion to EV-maker Rivian to build a Georgia plant they’ve already halted,†highlighting the cost of $880,000 per job as disproportionately high. This sentiment taps into a deeper narrative of political rivalry, suggesting that the loan might be a strategic move against Musk and Tesla, who have historically been pivotal in shaping the U.S. government's approach to electric vehicles.Rivian's Position in the EV Market

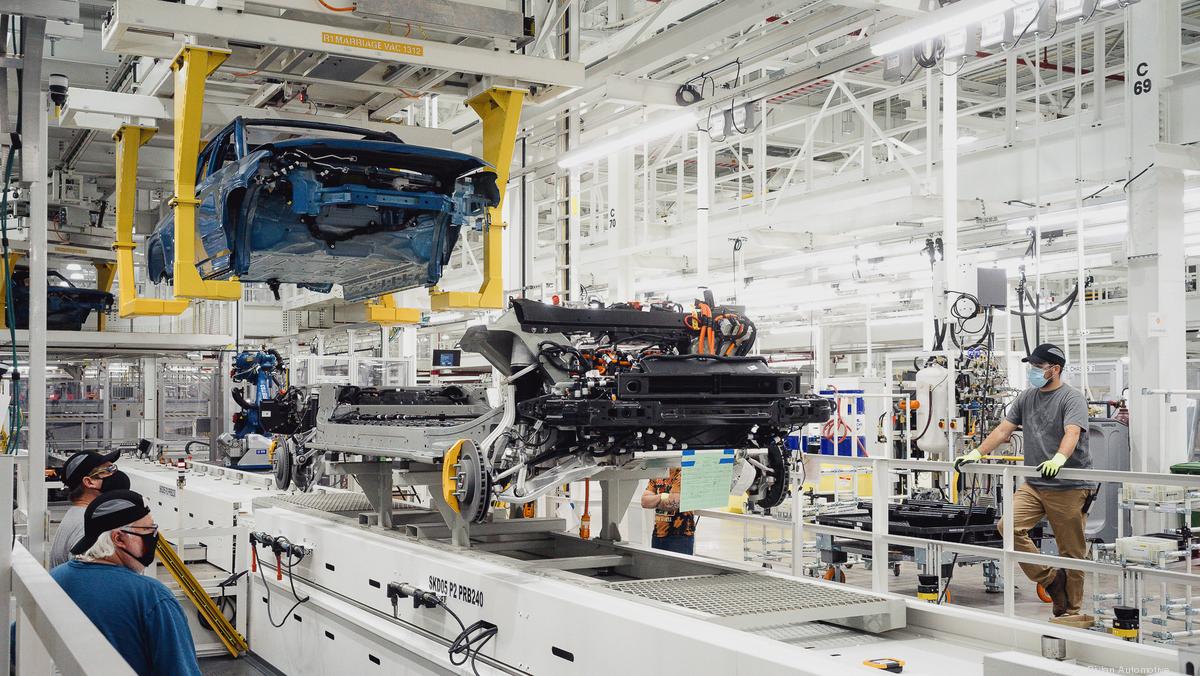

Rivian has positioned itself as a significant player in the EV industry, aiming to expand its manufacturing capabilities with a new factory intended for its R2 family of mid-size vehicles. However, the decision by Rivian CEO RJ Scaringe to delay the factory's construction to preserve capital has raised questions about the timing and necessity of the federal loan.

Economic Impact and Industrial Strategy

The debate over this loan is not just about the numbers. It also touches on the broader economic impact of fostering a competitive EV market. Proponents of the loan could argue that vehicle manufacturing plants are not only about direct employment but also about the economic ecosystems they nurture. These plants support a wide range of industries, from steel to electronics, enhancing local economies and contributing to technological advancements in automotive manufacturing.The Controversy Over Federal Loans and Market Intervention

This situation revives the long-standing debate over the role of government in the private sector. Critics, including those from The Wall Street Journal, have labeled the loan as "corporate welfare," arguing that it distorts market dynamics and involves a high-risk investment in a company that has yet to prove its financial viability. Conversely, supporters might point to the successful precedent set by Tesla, which repaid its federal loans with interest, as evidence that strategic government support can catalyze industry innovation and growth.

What Lies Ahead

As the new administration takes office, the scrutiny of the Rivian loan by figures like Ramaswamy and Musk will likely prompt a reevaluation of how the U.S. government invests in emerging technologies and industries. The outcome could reshape the landscape of government intervention in the private sector, setting precedents for how future technologies are nurtured and how economic policies are aligned with industrial innovation. In this high-stakes scenario, the decisions made today will not only affect the fortunes of Rivian but also influence the broader trajectory of the U.S. automotive industry and its role in the global shift towards sustainable transportation.corporate welfare, electric vehicles, EV industry, federal loans, government intervention, Rivian scrutiny, Tesla competitor