As the holiday shopping season kicks off with robust sales, and speculation about new fiscal policies stirs market optimism, giants like Amazon.com (AMZN) and Meta Platforms (META) are making significant moves. These industry leaders are at the forefront of a group of five stocks nearing buy points, signaling potential investment opportunities as the S&P 500 maintains its post-election rally.

Stock Market Enthusiasm Fueled by Political and Economic Shifts

The recent election results, which saw a GOP sweep, along with a favorable adjustment in federal interest rates, have propelled the S&P 500 to its best performance in a year, boasting a 5.7% increase. This surge is backed by investor optimism following President-elect Donald Trump's nomination of Scott Bessent, a noted fiscal hawk, as Treasury secretary. Bessent is expected to steer the U.S. economy through potential hazards such as bond-market fluctuations, which could be pivotal given the looming threat of trade wars and contentious immigration policies.Spotlight on Leading Stocks: Amazon and Meta

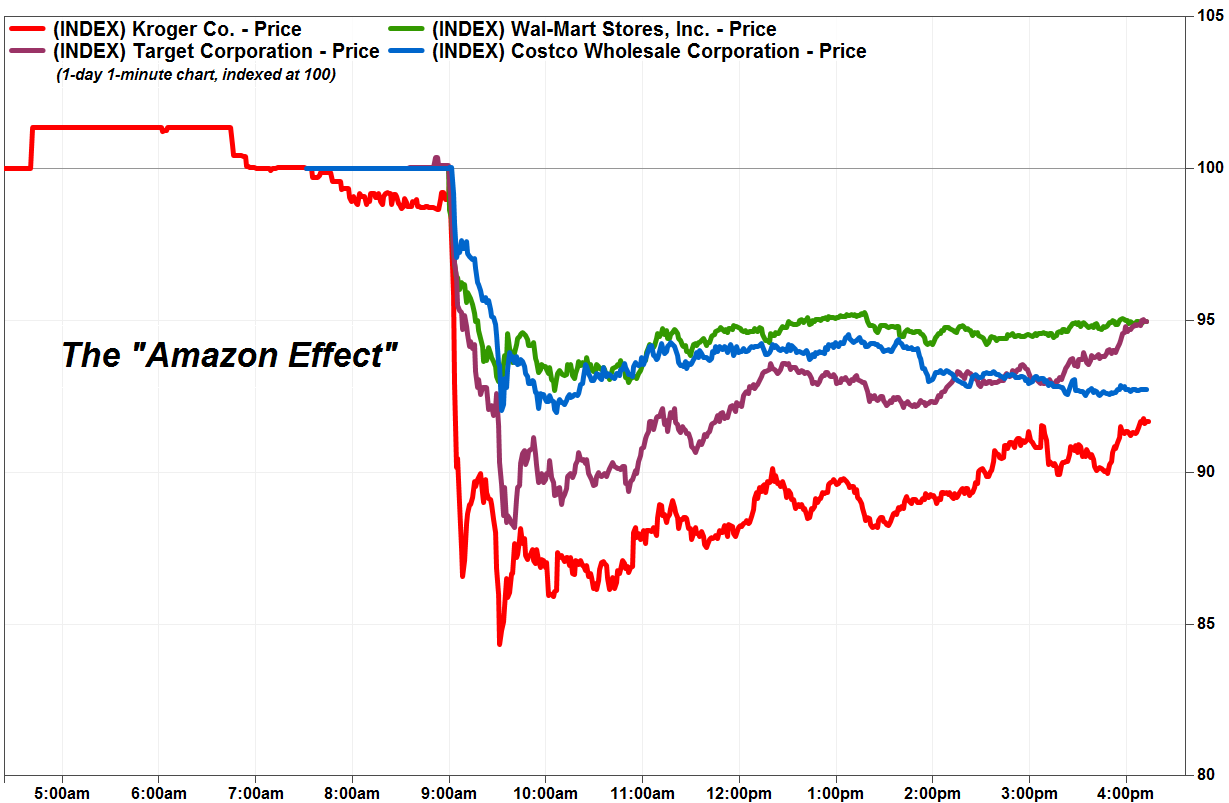

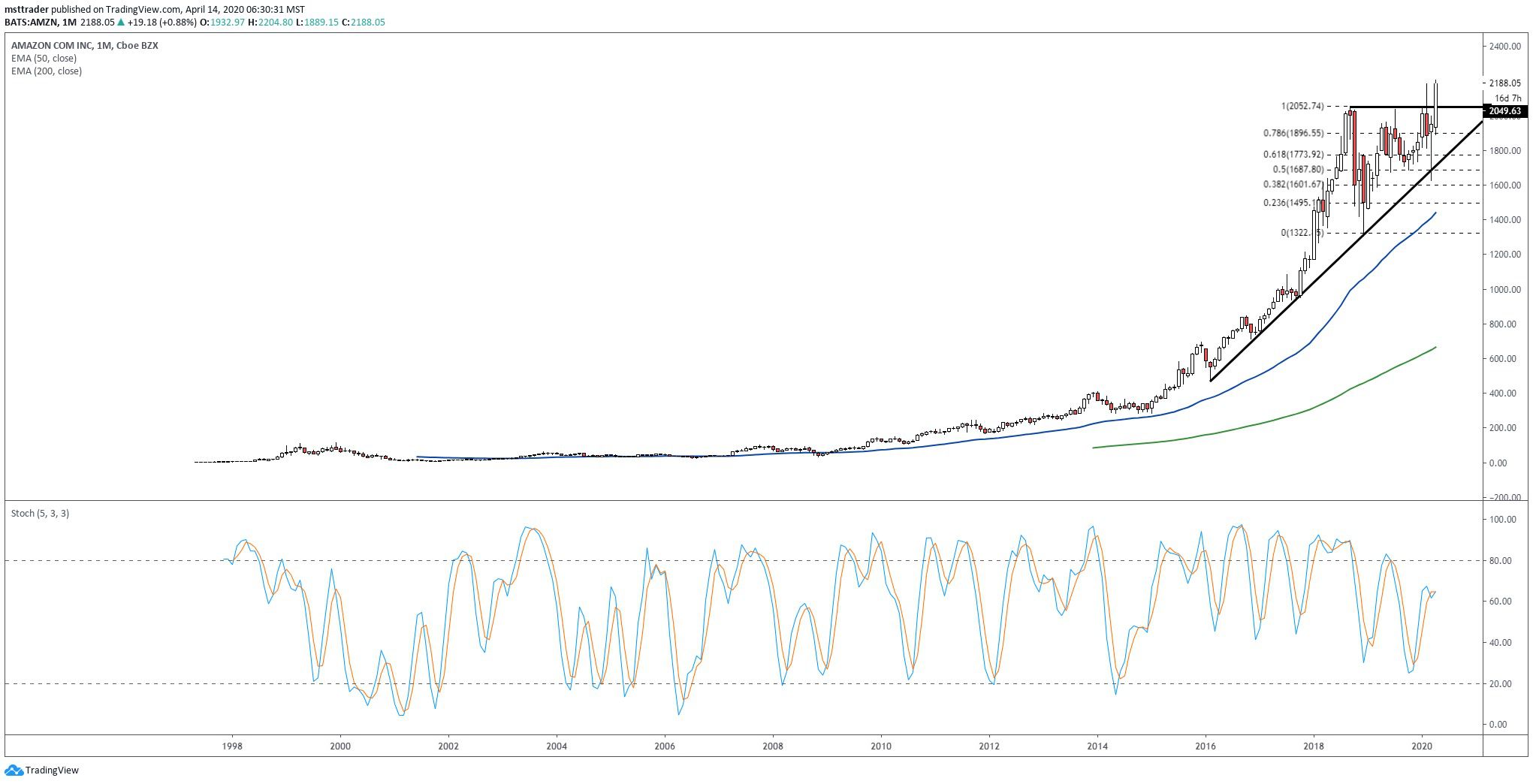

Amazon Sets the Pace in E-commerce

Amazon has reclaimed a critical buy point during the shortened holiday trading week, showing a robust 2.2% gain on Monday. This rise was spurred by a significant increase in Thanksgiving Day online spending, which saw a jump of 8.8% to $6.1 billion. Analysts, including those from Wedbush Securities, anticipate a record-breaking holiday season for Amazon, especially given the later timing of Thanksgiving this year, which bolsters consumer confidence in prompt delivery and service. Furthermore, Amazon's strategic advances in artificial intelligence and its recent investment doubling in Anthropic highlight its ongoing market dominance and innovation. Redburn Atlantic has recently upped Amazon’s stock price target from 225 to 235, maintaining a buy rating due to its formidable full-stack integration in Amazon Web Services and rapid market-share gains.

Meta Platforms: Adapting and Innovating

Meta Platforms, formerly known as Facebook, continues to adapt its strategy in the rapidly evolving social media landscape. Despite some challenges, including the political dynamics with President Trump and the competitive pressure from new platforms like Elon Musk's X, Meta is gearing up for a profitable restructuring with its new advertising initiatives on Threads and significant investments in artificial intelligence. Meta is closing in on regaining its 50-day moving average, offering a potential early entry for investors. The company has been highlighted as a top AI winner by Jefferies analysts, who are confident in its new business strategies involving generative AI tools for commercial use. Meta's stock edged up to 574.32, just shy of its 50-day line.Other Stocks to Watch: Berkshire Hathaway, Travelers, and Toll Brothers

Not to be overlooked, Warren Buffett's Berkshire Hathaway, Travelers Insurance, and luxury homebuilder Toll Brothers are also making headlines. Berkshire Hathaway benefits from potential tax cuts and deregulation favorable to its extensive portfolio in the financial sector, showing a promising rise to just below a strategic buy point.

Amazon stock, Berkshire Hathaway, buy points, economic growth, economic growthAmazon stock, holiday shopping, Meta Platforms, stock market