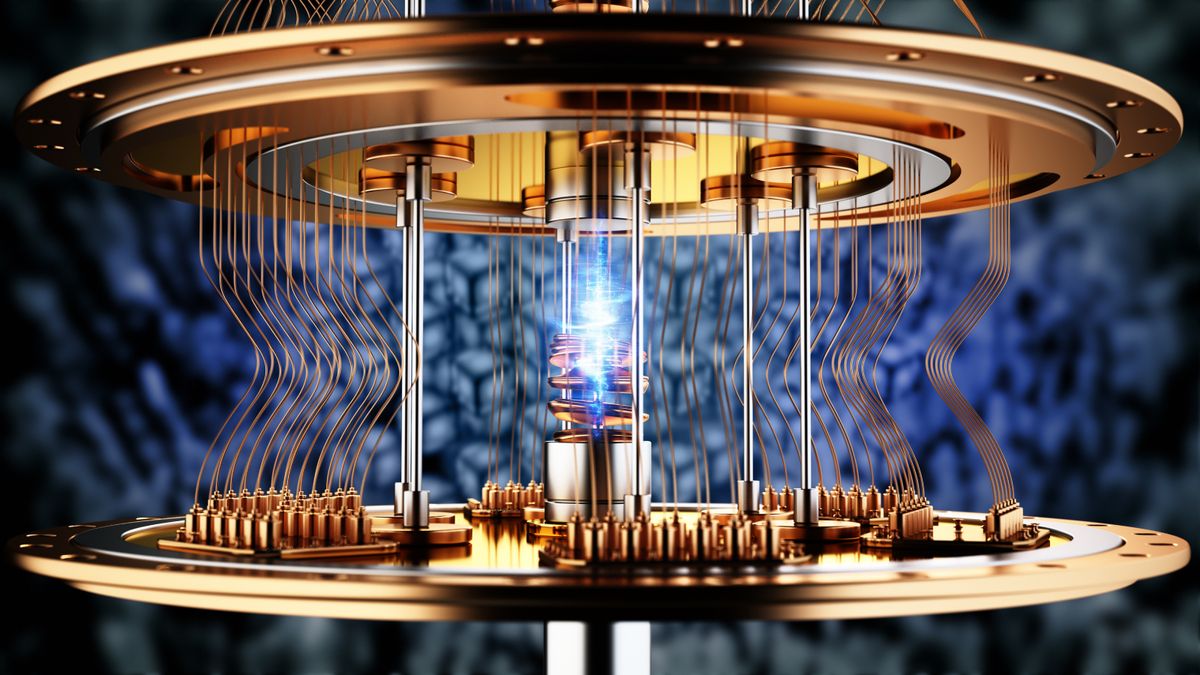

As the cryptocurrency market continues to evolve, the specter of quantum computing presents both a formidable challenge and an innovative opportunity. Microsoft's recent unveiling of its quantum computing chip, Majorana 1, marks a significant stride in the race to safeguard digital assets like Bitcoin from future quantum threats. This development could dramatically accelerate the timeline for creating quantum-resistant technologies in the cryptocurrency sphere.

The Quantum Computing Race Heats Up

On February 19, Microsoft launched Majorana 1, propelling itself to the forefront of the quantum computing landscape, an arena already populated by tech giants like Google, which introduced its quantum chip, Willow, in December. According to Bitcoin exchange River, while the threat posed by quantum computing to cryptocurrency is not imminent, the arrival of Majorana 1 could potentially shorten the timeline for necessary defensive measures. In a statement on X (formerly Twitter), River highlighted that "The Majorana 1 chip is far from that scale now, but could reach the 1 million qubit mark by 2027-2029... When ran for several days to weeks, a 1-million qubit QC could potentially crack Bitcoin addresses via a long-range attack." This projection underscores the urgency of advancing quantum-resistant cryptography to protect against such scenarios.Debating the Quantum Threat

Despite these advancements, the quantum threat to cryptocurrencies remains a topic of considerable debate. Critics argue that the fear surrounding quantum computing is overblown, with many suggesting that traditional financial institutions would likely be the primary targets of quantum attacks due to their vast asset holdings. According to Statista, global bank assets totaled more than $188 trillion in 2023, dwarfing the cryptocurrency market's $3.2 trillion capitalization, as per CoinMarketCap data.

Industry Preparations and Predictions

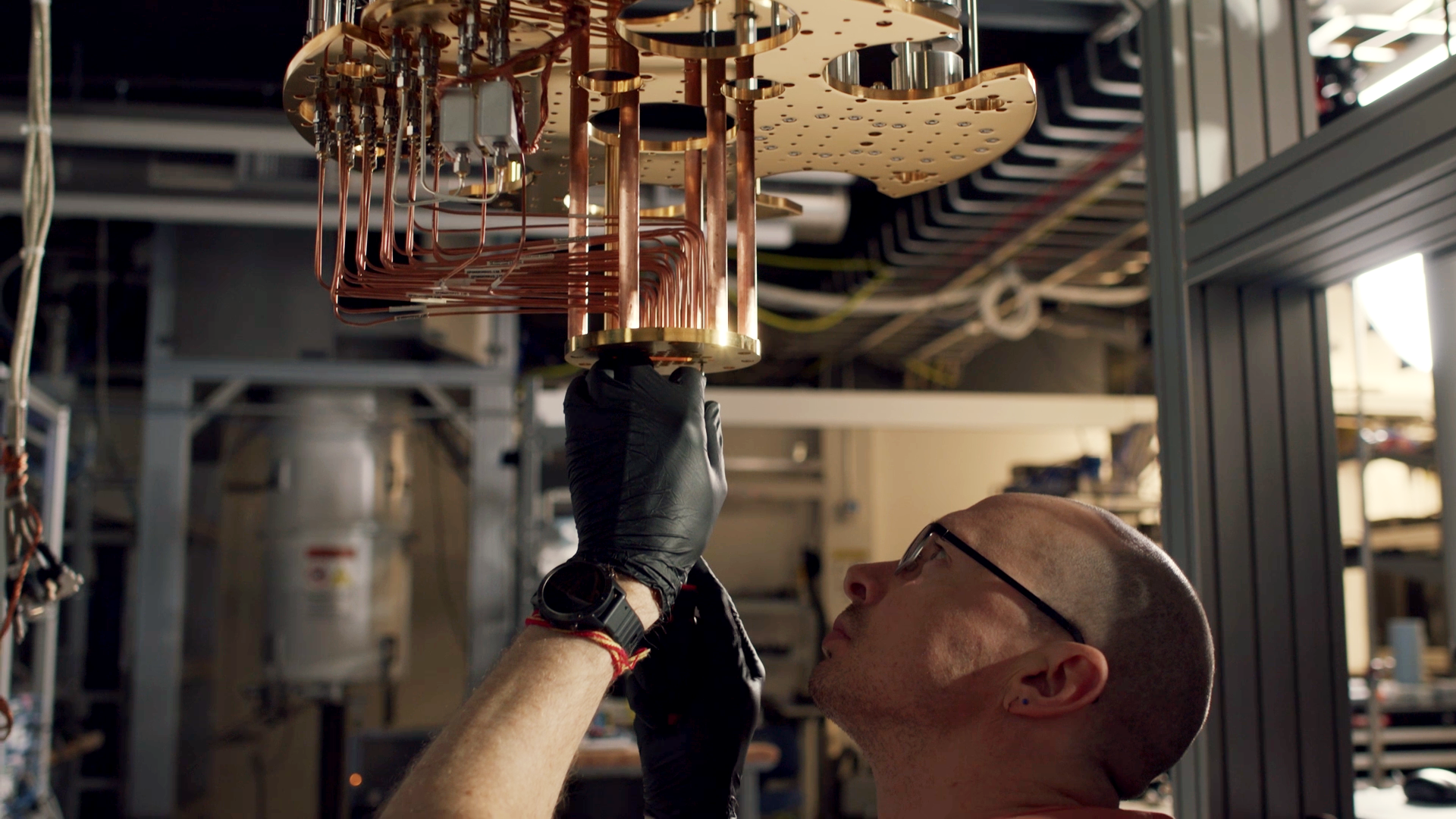

The cryptocurrency community is not sitting idle in the face of potential quantum disruptions. Initiatives like BIP-360, which aims to transition Bitcoin to a quantum-resistant framework through a soft fork, are gaining traction. Preston Pysh, co-founder of The Investor’s Podcast Network, emphasized the proactive steps being taken, stating that BIP-360 could be implemented relatively smoothly. On the other hand, skeptics like Adrian Morris argue that quantum computing is "barely a viable technology" at present, with significant hurdles still to be overcome in areas such as thermodynamics and reliable memory for computations.

bitcoin, blockchain technology, Crypto Threat, Cryptocurrency Security, Microsoft Majorana, quantum computing, Quantum Resistance