As global economic landscapes shift, Pimco, one of the largest bond managers in the world, outlines its strategic adjustments to mitigate risks associated with the growing U.S. debt and the phenomenon of bond vigilantism. With a keen understanding of market dynamics and government policies influencing the investment climate, Pimco's recent moves signal a pivotal shift in strategy.

Strategic Adjustments in Pimco's Portfolio

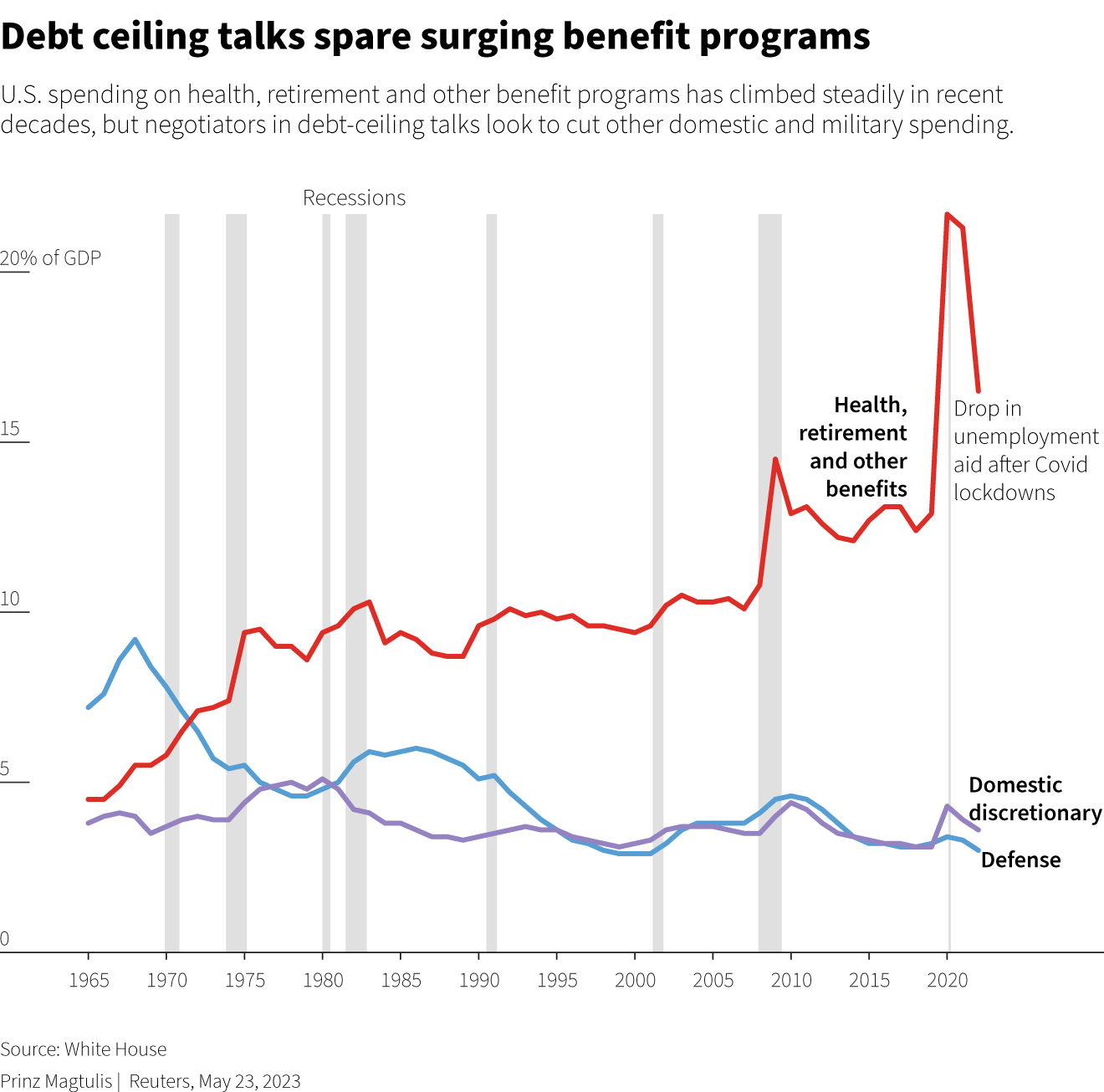

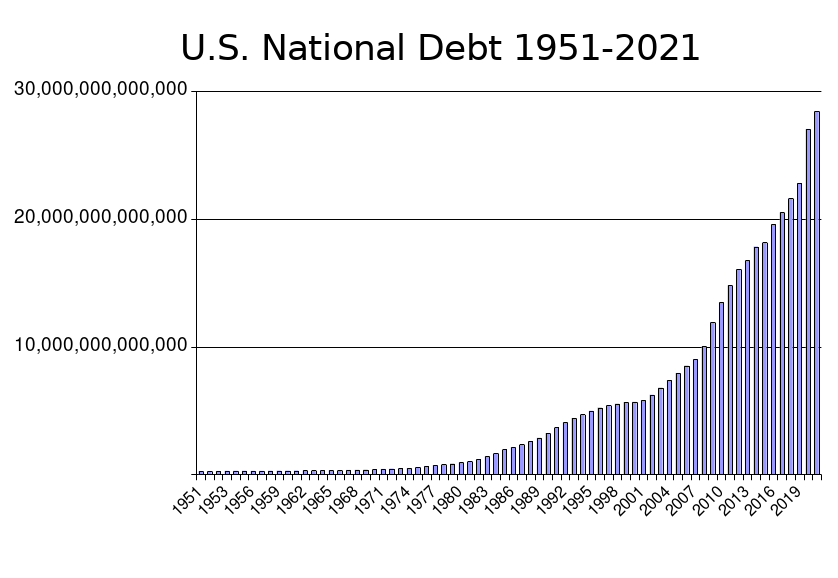

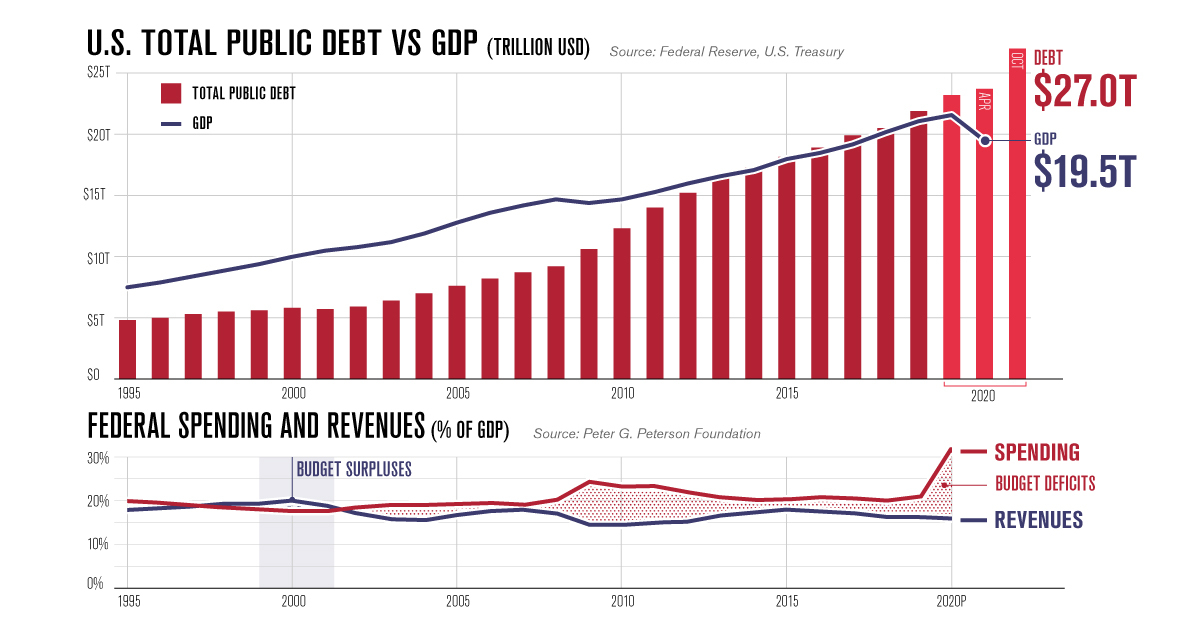

Facing an ever-worsening U.S. deficit scenario, Pimco has been proactively adjusting its portfolio by reducing allocations to longer-dated U.S. Treasury bonds. According to Marc Seidner, Pimco’s Chief Investment Officer of Nontraditional Strategies, and Pramol Dhawan, a portfolio manager at the firm, these bonds have become less attractive due to potential pressures that could drive longer-duration yields higher. Such pressures include rising inflation, economic growth, and substantial Treasury issuances needed to fund the U.S. deficit. "Over time, and at scale, that’s the kind of investor behavior that can fulfill the bond vigilante role of disciplining governments by demanding more compensation," Seidner and Dhawan explained. This strategic pivot underscores a broader trend of increasing vigilance in the face of potential fiscal challenges.A Dual Approach: Equity in the U.S., Debt in Europe

Pimco's strategy includes a significant geographical diversification. While reducing exposure to U.S. long-term debt, Pimco recommends increasing equity investments within the U.S., where a productivity and technology boom has buoyed corporate performance. Conversely, they advise shifting debt exposure to European markets, where fiscal positions are perceived to be more stable compared to the U.S.

The Global Perspective: Favoring Bonds from Stronger Economies

Expanding their strategy beyond the U.S. and Europe, Pimco is also looking to invest in bonds from other high-quality sovereign nations such as the U.K. and Australia. These countries are selected for their stronger fiscal positions, providing a safer haven for bond investments compared to the volatile U.S. market.Market Response and Future Outlook

Despite the strategic shifts, the markets have shown resilience. On the day of Pimco’s announcement, U.S. Treasury yields, such as the 1-month and 10-year notes, remained steady, reflecting a market that has already started adjusting to the new economic realities. Similarly, U.S. equity markets have continued to perform robustly, with major indices like the Dow Jones Industrial Average, the S&P 500, and the Nasdaq showing impressive annual gains.

bond vigilantism, equity investment, European bonds, fiscal policy, Pimco strategy, Treasury yields, U.S. debt